Carnets de route contains information specifically aimed at refugees and refugee claimants, as well as the people assisting them. Carnets de route is intended to help you with the process of settling in when you arrive and during your first few years in Québec.

With Carnets de route, you will enjoy an engaging experience: reliable, organized and accessible information about Québec society, steps to take, to-do lists, timelines, summary diagrams and much more!

Select whether you would like to view the website in English or French, then answer the following three questions to be directed to the right information.

Your profile

Refugee Claims

Accepted Refugee Claims

Refused Refugee Claims

Refugees

Finances

Key organizations and individuals

1. Updates – Finances

The content of Carnets de route was updated in November 2023, unless otherwise indicated. Some elements may have changed since then. If in doubt, consult the sources and resources in this section. You can also report any information requiring change through Technical Support. Update dates may vary by section.

2. Bank account

(TCRITable de concertation des organismes au service des personnes réfugiées et immigrantes , 2021; Ville de Sherbrooke, 2023c)

In Canada, the banking system is regulated and secure.

2.1 Opening an account

(Agence de la consommation en matière financière du Canada, 2023b)

You need an account at a financial institution (bank or credit union) to be paid for work or receive money from social assistance.

You can open an account even if you don’t have a job or money to deposit yet.

Your host organization or sponsorship group will help you open your bank account.

If you are still staying in temporary accommodation when you open your account, provide a secure address where you can receive mail (for example, at a friend’s home). Remember to notify your financial institution of your change of address and contact information.

2.1.1 Steps to follow

- Receive your SINSocial insurance number

If you don’t have your SINSocial insurance number

, you can use your Refugee Protection Claimant Document or your Acknowledgement of Claim to open a bank account.

- Choose a financial institution (bank or credit union)You can search for and choose the financial institution that suits you best, or ask your counsellor for advice. Find out which financial institutions are located near you. Also compare the costs associated with bank accounts (monthly costs, interest rates, etc.). Some financial institutions offer multilingual services and personalized programs for newcomers.

- Make an appointment

Bring:

- Your CSQQuébec Selection Certificate

- Your Refugee Protection Claimant Document or your Acknowledgement of Claim

- Your SINSocial insurance number if you have one

- All your photo IDs

These documents must be originals. Photocopies are not accepted. When you make your appointment, confirm with your future financial institution whether these documents are sufficient.

Once you have opened your bank account, you will get a debit card, which you can use to spend the money you have deposited in your account.

2.2 Sending money online

(Agence de la consommation en matière financière du Canada, 2023a; Interac Corp., 2023)

2.2.1 Interac e-Transfers

Most financial institutions allow you to send and receive money by Interac e-Transfer. This is a free, fast and useful way to pay your rent and other expenses in Canada. You must have the recipient’s email address or cell phone number to use it. For more information, ask your financial institution how to use Interac e-Transfer.

2.2.2 International money transfers

If you want to send money abroad or receive money from outside of Canada (for example, sending money to your family in your country of origin), you have several options:

- International money transfer companies (for example, Western Union)

- A money transfer platform (for example, PayPal)

- International Interac e-Transfer, How to send money through International Transfer – Interac

Check the fees associated with each of these options.

2.3 Credit card

(Éducaloi, 2023f; Les clés de la banque, s. d.)

Credit is money that you are advanced, usually by your financial institution. You can use your credit through a credit card, which allows you to:

- Spend money you don’t already have, for example to buy something without having to wait

- Repay your expenses later, sometimes in instalments

- Build your credit history

Credit history is a record of your financial situation indicating whether you have any debts and, most importantly, whether you are in a position to repay them. Your credit history can be checked when you rent a home or buy a car.

It is important to pay your credit card bill in full by the monthly deadline to avoid paying high interest fees on top of the original amount.

Make sure you can always pay off your credit card in full by the deadline. Properly managing your credit card payments will have a positive impact on your credit history, which will make it easier to find a place to live or apply for a loan later on.

“You have to remember that a credit card is not like having extra money. You have to be very careful, because it is really debt. Banks are not your friends or your family. The more you owe, the more it benefits them. I’ve seen people take out credit cards, buy things, and now they’re over $4,000 in debt. And that has an impact on the future.” – Bernadette

Some contractual expenses (for example, phone plans, private lessons, etc.) require automatic payments from your credit card. Make sure you can afford these.

3. Fraud

(Commission des services financiers et des services aux consommateurs, 2018; Dumas, 2021; francois.charron.com, 2023)

- Beware of companies that lend money quickly and easily. Some charge high interest rates. Others may make you pay upfront and then disappear with your money.

- Beware of companies that offer international money transfers. Just because a company runs ads or seems to have a physical office doesn’t mean it is legitimate.

- Some scammers may pretend to be the CRACanada Revenue Agency to get money from you or obtain your banking information. Visit this website to find out how to protect yourself: Fraud targeting newcomers – Canada.ca.

- Never share the personal identification numbers (PINPersonal identification number ) for your debit or credit cards.

3.1 For more information

Office de la protection du consommateur

If you have experienced fraud or for information

4. Financial assistance

(Cleveland, Hanley, Salamanca Cardona, et al., 2021; Collectif Bienvenue, 2023d; IRCCImmigration, Refugees and Citizenship Canada , 2023o; Jobin-Théberge & Bombardier, 2020b; MIFIMinistère de l’Immigration, de la Francisation et de l’Intégration (du Québec) , 2023; Services juridiques de Pointe-Saint-Charles et Petite-Bourgogne, 2017; TCRITable de concertation des organismes au service des personnes réfugiées et immigrantes , 2021)

4.1 Social assistance program

(Éducaloi, 2023b; Gouvernement du Québec, 2023n, 2023s, 2023z)

Social assistance is a type of last-resort financial assistance:

- For people who can work but don’t have a job

- For people who should be able to work but are temporarily unable to (for example, you are temporarily injured, you are an informal caregiver, you are at least 20 weeks pregnant, etc.).

You can work while you receive social assistance. A number of conditions apply. As soon as you know you are going to work, you must inform the social aid officer that you are starting a job. Otherwise, you could be accused of fraud and have to repay the money you received from the government.

4.1.1 Eligibility criteria

To receive social assistance, you must:

- Be aged 18 or over (with a few exceptions)

- Reside in Québec (there are restrictions for stays outside the province)

- Have limited financial resources

- Other criteria may apply.

4.1.2 Steps to follow

If the application is accepted, expect to receive the first and subsequent payments on the first day of each month. You will also receive a claim slip each month along with your deposit notice or cheque. This slip proves that you are receiving social assistance.

4.2 Social solidarity program

(Éducaloi, 2023b; Gouvernement du Québec, 2023n, 2023s, 2023z)

The social solidarity program is another last-resort financial assistance program. It is similar to the social assistance program, but for people who are unable to work because of their physical or mental condition. The amount you get is slightly higher than for social assistance.

A medical report is required to apply to the social solidarity program.

To apply for social solidarity, follow the same steps as you would to apply for social assistance (see the steps above).

4.3 Family benefits

(Agence du revenu du Canada, 2022; Retraite Québec, 2023)

You are not entitled to family benefits during the refugee claim process, even if your child was born in Canada.However, as a refugee claimant, you may be entitled to financial benefits from the PRAIDAProgramme régional d’accueil et d’intégration des demandeurs d’asile (English: Regional Program for the Settlement and Integration of Refugee Claimants) under some pre-established conditions:

- If you have three or more dependent children: PRAIDAProgramme régional d’accueil et d’intégration des demandeurs d’asile (English: Regional Program for the Settlement and Integration of Refugee Claimants) family budget supplement

- If you have a child with special needs: PRAIDAProgramme régional d’accueil et d’intégration des demandeurs d’asile (English: Regional Program for the Settlement and Integration of Refugee Claimants) allowance for children with special needs

Your children must be in Québec and must be under 18. Call the PRAIDAProgramme régional d’accueil et d’intégration des demandeurs d’asile (English: Regional Program for the Settlement and Integration of Refugee Claimants) if you are in one of these situations: 514 484-7878, extension 64500.

If you have children, you are entitled to these two income-based family benefits for each of your children:

- Québec family allowance – Québec

- Canada child benefit – Canada

Apply as soon as possible. This can be done when your child is born. It takes a few months to receive the first payments.

4.4 Other benefits

There are many other financial assistance programs for which you may be eligible if you have worked a certain number of hours. For example:

- When you or your spouse gives birth to a child

- Parental insurance: What is the Québec Parental Insurance Plan?

- When you lose your job

- Employment insurance (unemployment): Employment Insurance benefits – Canada.ca

- For your retirement

- Québec Pension Plan: Retraite Québec – The Québec Pension Plan

- Canada Pension Plan: The Canada Pension Plan

- The Old Age Security pension, if you are aged 65 or over: Old Age Security pension – Canada.ca

- A financial supplement if you are pregnant and receiving social assistance or social solidarity.

- A financial supplement for housing assistance. See the Housing section.

- Financial assistance if you are taking French courses. See the Learning French section.

- Allowances to get training or look for a job. See the Employment section.

It can be hard to meet your basic needs on government financial assistance alone. Until you can start working, you will probably feel financially squeezed.

5. Income taxes

(Agence du revenu du Canada, 2023c; Collectif Bienvenue, 2023d; Éducaloi, 2019; Gouvernement du Québec, 2023ae, p. 1; Revenu Québec, s. d.-b; Ville de Sherbrooke, 2023c)

5.1 How taxes work

Every year, everyone living in Québec must file an income tax return by April 30.

On your tax return, you report all income received during the previous year (January 1 to December 31) to the provincial and federal governments. You must declare your income from your first day in Canada until December 31.

You must complete:

- A provincial tax return for Revenu Québec

- A federal tax return for the CRACanada Revenue Agency

5.2 Benefits

(Agence du revenu du Canada, 2023a)

Depending on your financial and family situation over the past year, you may receive a refund or be required to pay taxes. Doing your taxes gives you access to certain government services (education, health, recreation, etc.) and programs (Shelter Allowance, social assistance, employment insurance, parental leave, etc.).

Filing your tax return also helps to maintain these government services and programs.

“Our taxes are what provide us with the RAMQRégie de l’assurance maladie du Québec and a full range of public services. I think it’s important to do your taxes to give back to other people who are in the same situation as you were.” – Bernadette

5.3 Steps to follow

Your host organization or sponsorship group will help you complete these steps.

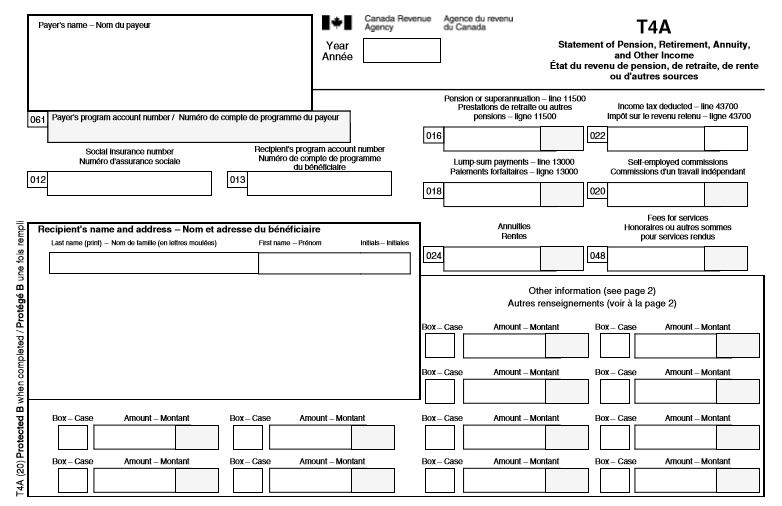

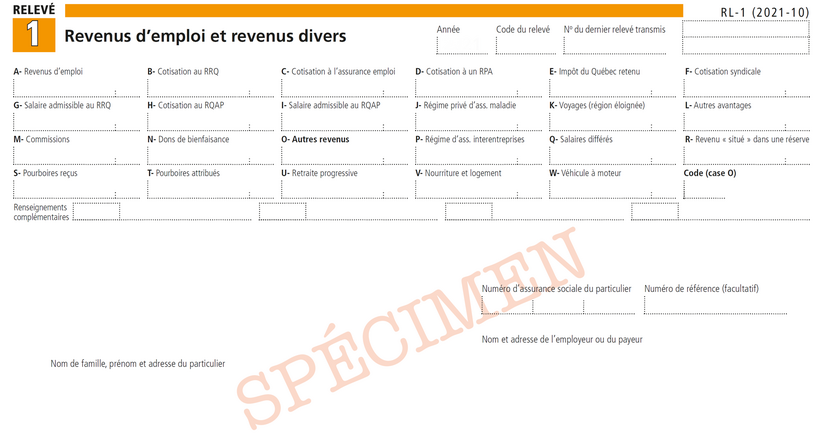

- Collect all T4 slips, Relevé 1s and other documents.

Your employers, the Government of Québec and the Government of Canada will send you T4 and Relevé 1 slips in the mail or online. Depending on your situation, you may receive other documents, for example from your daycare centre, property owner, etc. You may need to apply to the relevant authorities to receive some other documents (health insurance, etc.).

Make sure you change your address to receive your tax slips.

- File your tax return.

- By paying an accountant or bookkeeper to complete your tax return.

OR

- By finding a low-income tax clinic or a community organization to help you file your tax return. Some clinics are only open during the tax season. Be sure to make an appointment in advance.

OR

- By filling out your return yourself (on paper or online through the CRACanada Revenue Agency and Revenu Québec online portals). This may be more difficult.

- Send your returns to Québec and Canada. You will receive a refund or pay the balance owing.

- You will receive your notices of assessment in the mail or through your personal CRACanada Revenue Agency and Revenu Québec online accounts.

Keep your notices of assessment in a safe place.

It is illegal to submit a false tax return, for example by declaring less money than you earned. This could lead to fines or even legal issues.

5.4 Tax resources

Revenu Québec

Canada Revenue Agency

211

Multilingual – Information and referral service for social and community services

To-do list

Open an account at a financial institution (bank or credit union)

Choose a financial institution that accepts refugee claimants and make an appointment

Credit card: pay it off in full every month to avoid paying high interest fees

Credit card payment date:

Apply for financial assistance, if eligible

See the Finances section of Carnets de route to find out more about available financial assistance and steps to follow

Apply for social assistance and/or social solidarity

: as soon as you arrive

: after your first year in Québec

Fill out your tax return

Gather your documents

Contact a tax clinic, community organization or accountant

Send your tax return

Deadline to submit Québec and Canadian tax returns each year: April 30

Keep your notices of assessment in a safe place

Report a change of address or email as soon as possible: see the Read This Information First section of Carnets de route